Understanding Gold Bar Weight Units

Gold bars, the quintessential symbol of wealth and power, come in a variety of weights and sizes. But did you know that the weight of gold bars is not measured in the same way as everyday items? Let’s delve into this fascinating world.

Gold Weights: Troy Ounces, Kilograms, and Pounds

When it comes to gold, the standard unit of measurement is the troy ounce. Not to be confused with the avoirdupois ounce, which is used for everyday items. A troy ounce is slightly heavier, weighing in at 31.1 grams compared to the avoirdupois ounce’s 28.3 grams.

Gold bars also come in kilograms and pounds. But remember, these are not your average kilograms and pounds. They’re based on the troy system, which is used for precious metals.

From Troy Ounces to Avoirdupois Ounces

The difference between troy ounces and avoirdupois ounces can be confusing. But it’s crucial to understand this if you’re dealing with gold.

A troy ounce is about 10% heavier than an avoirdupois ounce. So, if you’re buying a gold bar that’s listed in troy ounces, remember that you’re getting more than if it were in avoirdupois ounces.

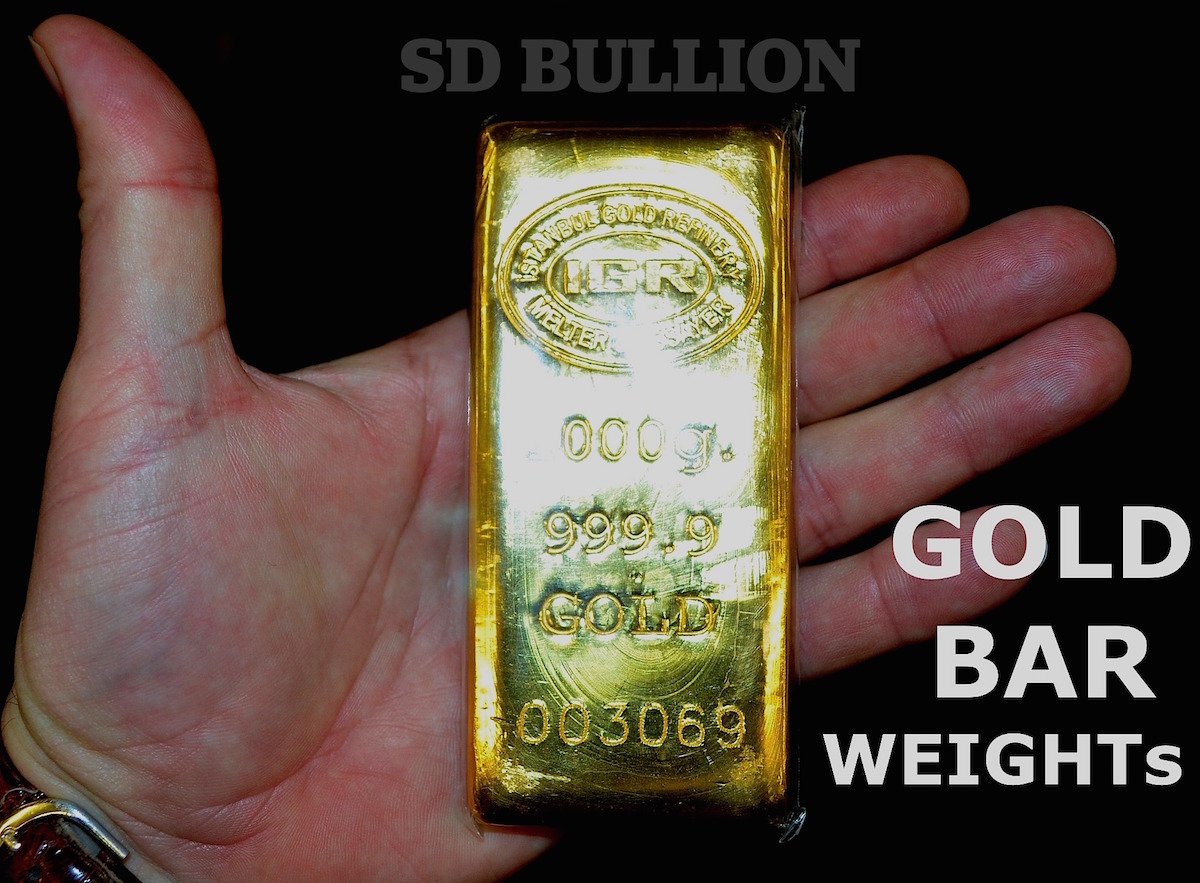

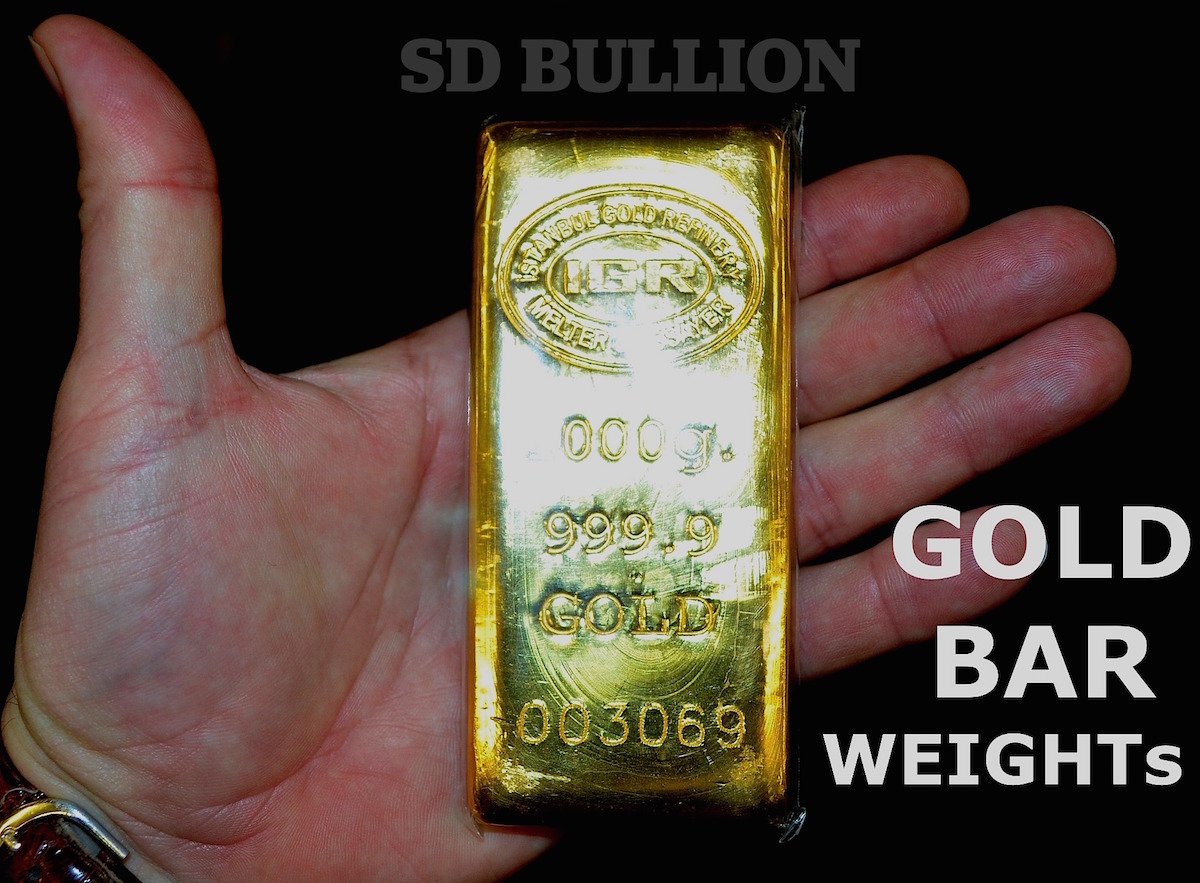

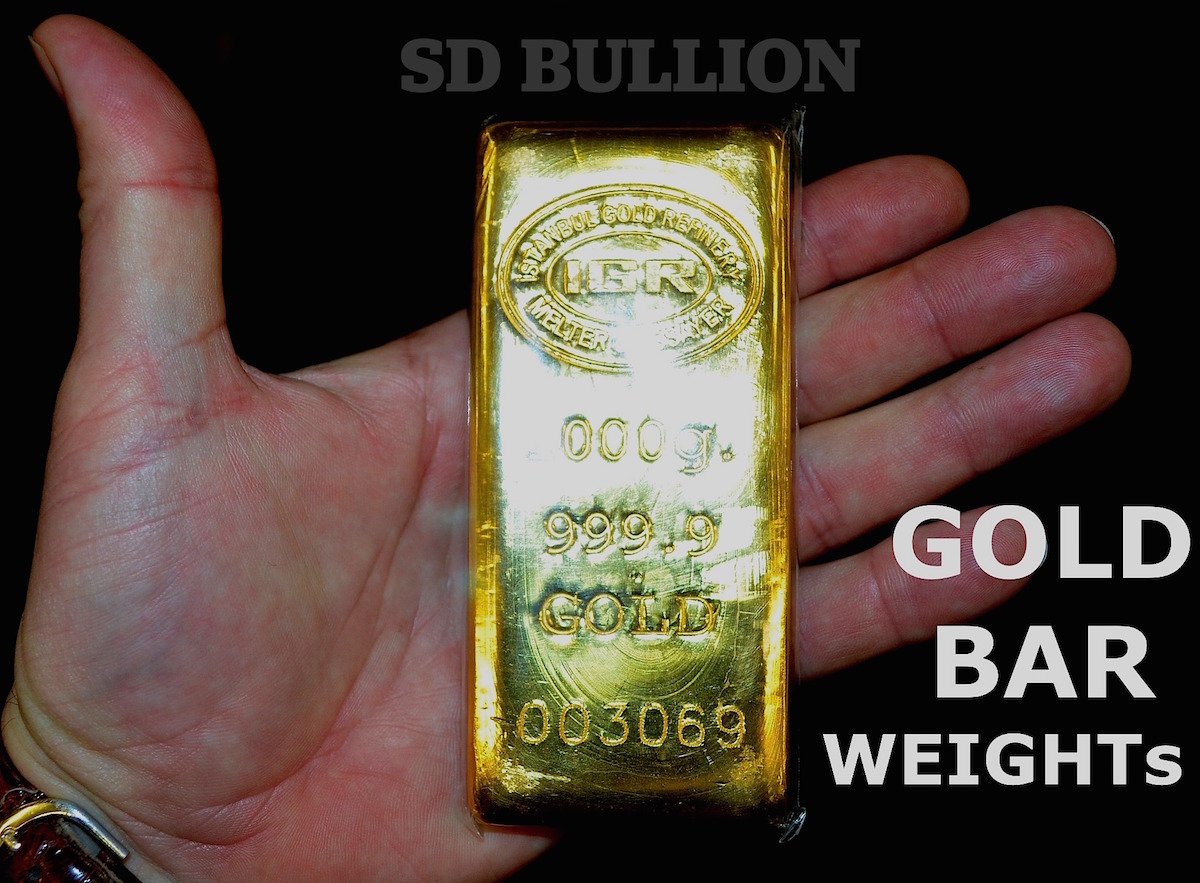

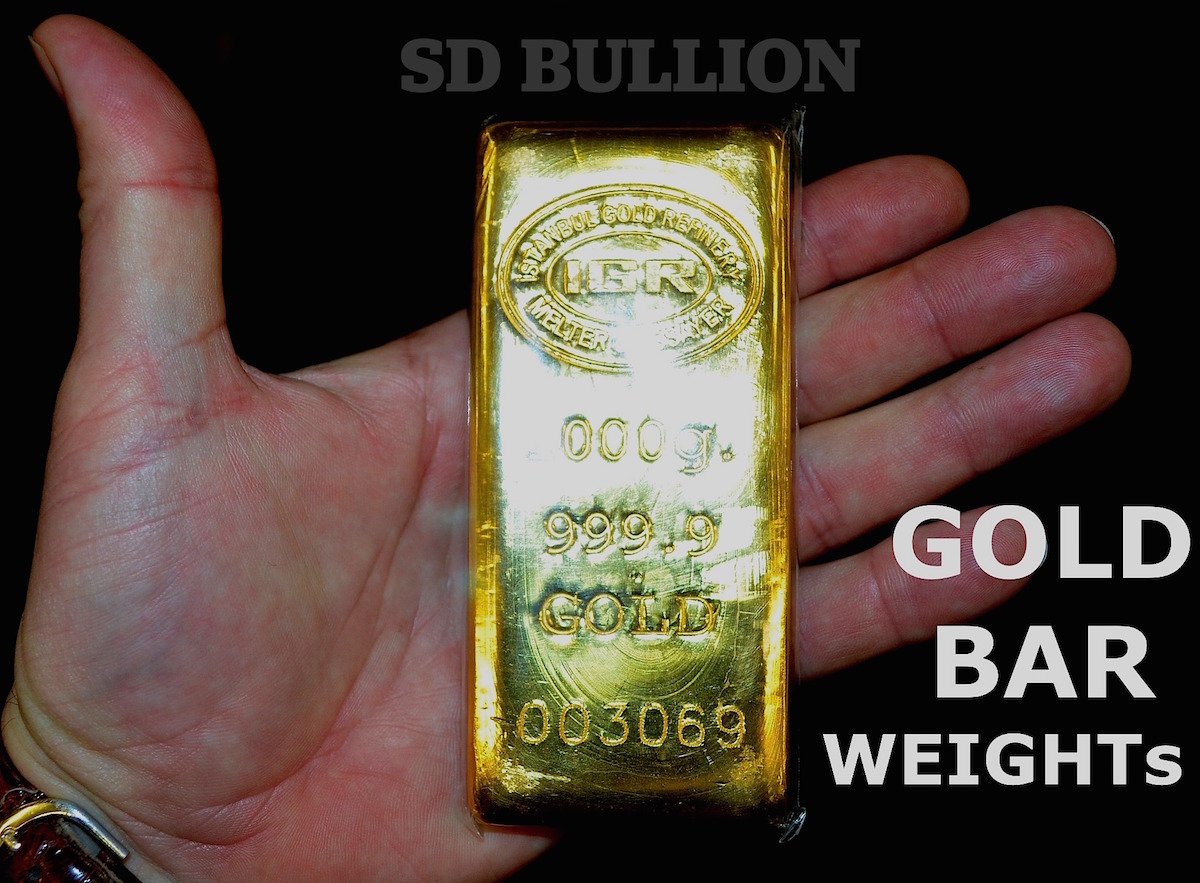

Gold Bars: Weights and Sizes

Gold bars come in a range of weights and sizes. From tiny 1 gram bars, perfect for gifting, to hefty 1 kilo bars, ideal for serious investors.

The standard “Good Delivery” gold bar, recognized worldwide, weighs a hefty 400 troy ounces. That’s about 27.5 pounds! It’s valued at roughly $750,000, making it a significant investment.

Other common gold bar sizes include 1 oz, 5 oz, 10 oz, and 1 kilo.

These are popular among investors for their versatility and ease of storage.

Gold Bar Weights Around the World

Different countries have their own traditional gold bar weights. In India, there’s the Tola Biscuit/Bar. China has the Tael Biscuit/Bar. And in Thailand, it’s the Baht Biscuit/Bar.

The largest gold bar in the world weighs a staggering 250 kg. That’s 551 lb! It was manufactured by the Mitsubishi Materials Corporation, a testament to their expertise in precious metals.

Avoirdupois Ounces for Everyday Items

While troy ounces are used for precious metals, avoirdupois ounces are used for everyday items. This includes things like groceries, postage, and anything else you might weigh on a daily basis.

Gold Bars: Manufactured with Precision

Gold bars are manufactured with precision by bar producers. This can be done through pouring molten metal into molds, creating ingots. Or by minting/stamping from rolled gold sheets.

Each method results in a gold bar of exact weight. Any deviation indicates a fake. So, make sure you’re buying from a reputable source, like the United States Gold Bureau.

In the world of gold, understanding weights and measurements is key. It can be the difference between a good investment and a great one. So, whether you’re a seasoned investor or a novice, it’s worth taking the time to learn the ins and outs of gold bar weight units.

Gold Bar Weight Conversion Simplified

Diving into the world of gold can be a thrilling adventure. But it can also be a bit confusing, especially when it comes to understanding gold bar weights. Fear not! We’re here to simplify things for you.

What’s in an Ounce?

First things first, let’s talk about ounces. When it comes to gold, we use a special kind of ounce called the troy ounce. It’s a bit heavier than the regular ounce, weighing in at 31.1 grams. That’s about 10% more than the regular ounce, which weighs 28.3 grams.

But why do we use troy ounces for gold? It’s a tradition that dates back to the Middle Ages. Troy ounces were first used in Troyes, France, a major trading city at the time. They made transactions simpler and more standardized. And the system stuck around.

Converting Troy Ounces

So, how do you convert troy ounces to other units? It’s easier than you might think.

To convert troy ounces to grams, simply multiply the number of troy ounces by 31.1. For example, if you have a 5 troy ounce gold bar, it would weigh approximately 155.5 grams (5 x 31.1 = 155.5).

Converting troy ounces to kilograms is a bit trickier.

One kilogram is equal to 32.1507 troy ounces. So, to convert troy ounces to kilograms, you would divide the number of troy ounces by 32.1507.

Watch Out for Misleading Listings

Here’s a word of caution: some sellers might list their products in regular ounces instead of troy ounces. This can make their gold bars seem like a better deal than they actually are. Always double-check the unit of measurement before making a purchase. Companies like the Midwest Bullion Exchange list all their items in troy ounces for your convenience.

Gold Bar Weight Converter

If all this math is making your head spin, don’t worry. There are plenty of online tools that can do the calculations for you. The Google unit converter is a handy tool that can convert troy ounces to grams, kilograms, or pounds in a snap.

Final Thoughts

Understanding gold bar weight conversion is crucial when dealing with gold. It can help you make informed decisions and avoid potential pitfalls. Remember, knowledge is power. And in the world of gold, it can also be wealth. So, keep learning, keep exploring, and let the adventure continue.

The Science Behind Gold Bar Weight

Gold, a precious metal, is not just about its lustrous appeal. It’s also about its weight and density. Let’s delve into the science behind gold bar weight.

Gold’s Density

Gold is denser than water. Its density is 19 gm/cm3, almost twice that of silver. The density of gold depends on how closely packed the atoms are in its crystal lattice. Interestingly, gold and silver have almost identical lattice constants, but gold’s density is almost twice that of silver.

Gold’s Weight

The weight of an object is the force exerted on it due to Earth’s gravity. The weight of a body can vary by about 0.3% at different locations. But remember, gold is bought and sold in units of mass, not weight.

Gold’s High Density

Gold’s high density compared to other precious metals, such as silver, is one of its unique features. This high density is due to how closely packed the atoms are in the crystal lattice.

Gold’s Changing Density

Did you know that metals expand and their density decreases as they get hotter? The density of gold decreases as it approaches its melting point.

Gold Bar Manufacturing

Gold bars are manufactured in two ways: cast and minted. Cast bars are made using a mold and poured liquid metal, resulting in a natural, organic appearance. On the other hand, minted bars are created using a continuous casting machine and cutting with a die.

They have various designs and undergo quality assurance tests. They are polished and come with packaging and assay details.

Choosing Between Cast and Minted Bars

While a premium is paid for minted bars, they offer added security and uniformity. Cast bars, however, are more cost-effective and unique, available in greater weights. The BullionMax website offers both cast and minted gold bars and provides a comprehensive guide on the differences.

Counterfeit Gold Detection

The Archimedes principle can be used to detect counterfeit or under-title gold based on density. This principle can help you ensure that you’re getting the real deal when buying gold.

Gold Bar Weight and Density

The Oxford Gold Group provides information about gold bar weights and density. This knowledge can help you make informed decisions when dealing with gold.

To sum up, the science behind gold bar weight is fascinating. It’s not just about the weight, but also about the density and manufacturing process. Understanding these aspects can help you make the right choices when buying gold. So, keep learning and exploring the world of gold.

Historical Significance of Gold Bar Weight

Gold bar weights have played a significant role in trade and commerce throughout history. They’ve been used as a standard of value, facilitating transactions across different cultures and regions. Let’s take a journey back in time to understand the historical significance of gold bar weights.

Gold Bar Weights in Ancient Trade

Centuries ago, gold bar weights were a common sight in the bustling markets of ancient civilizations. In Ghana, for instance, gold bar weights, known as ‘abrammuo,’ were used to measure the amount of gold being bought or sold. These weights were not just functional but also held cultural significance. The Akan people believed that the owner’s soul became stored in the weights over time.

Influence of Islamic Traders

Islamic traders greatly influenced the design of early gold bar weights. However, as time passed, the designs evolved to feature animals, tools, and even weapons. These intricate designs added an artistic dimension to these weights, making them more than just tools for trade.

Gold Bar Manufacturing Techniques

Gold bar weights were traditionally made through direct casting or lost wax casting techniques. These methods allowed for precise measurements, ensuring the accuracy of transactions. Today, the manufacturing process of gold bars has become more advanced, but the principles remain the same.

Gold Trade in Sub-Saharan Africa

Fast forward to the present day, the gold sector in sub-Saharan Africa produces about 25% of the world’s gold annually. Recognizing the potential of this sector, the U.S. Department of State issued an advisory focused on the gold trade in the region.

The aim is to encourage responsible investment and develop a sustainable gold sector.

Gold Bar Weights Today

Today, gold bar weights vary, with the most common being 1 oz, 5 oz, 10 oz, and 1 kilo gold bars. The world’s largest gold bar weighs an impressive 551 lb. These bars are tested for authenticity by checking if their weight matches the stamped weight.

Gold’s Volatile Price

The price of gold can be volatile. For instance, the price of a 28-pound gold bar ranged from $623,564.41 to $646,880.19 in just two months in 2020. Despite this volatility, gold remains a sought-after investment.

Buying Gold Bars

If you’re considering investing in gold, the United States Gold Bureau is a reliable distributor of gold, silver, and platinum coins. They offer free shipping on all items and have a minimum order requirement of just $99.

Preserving Gold Bar Weights

As we’ve seen, gold bar weights hold historical and cultural significance beyond their material value. Therefore, it’s crucial to preserve these weights and pass on the knowledge to future generations.

So, the next time you hold a gold bar, remember that you’re not just holding a piece of metal. You’re holding a piece of history that has shaped trade and commerce across centuries.

Choosing the Right Gold Bar Weight

When it comes to investing in gold, one of the most crucial decisions you’ll make is choosing the right gold bar weight. This choice can significantly impact your investment’s liquidity, storage, and overall cost.

Understanding Gold Bar Weights

Gold bars come in a variety of weights. The most common ones are 1 oz, 5 oz, 10 oz, and 1 kilo gold bars. However, there are also gram-sized gold bars, which are generally the least expensive and easiest to store. On the other end of the spectrum, you have larger bars like the 400 oz gold bars often used by central banks and institutional investors.

Consider Your Budget

Your budget plays a significant role in determining the right gold bar weight for you. Fractional gold bars, which are less than one ounce, are popular among investors with different budgets. These bars offer a lower entry point into gold investment. On the other hand, larger bars like the one-ounce and kilo bars have a lower premium per ounce but require a larger cash outlay.

Think About Storage

Storage is another factor to consider when choosing a gold bar weight. Smaller bars are easier to store at home or in a bank safe deposit box. Larger bars, however, may require more secure storage solutions like maximum security facilities.

Reputable Mints

Whether you’re buying gram-sized bars or kilo bars, it’s important to purchase from reputable mints. These mints produce gold bars composed of 24k .999 fine gold.

Bars with less than .999 fineness may be illegal or unethical. Some renowned gold refiners are located in Switzerland, known for its high-quality gold products.

Buying from Trusted Dealers

Buying from trusted dealers or companies is crucial to avoid counterfeit bars. The Money Metals Exchange and JB Bullion are reliable distributors of gold bars. They offer a wide range of gold bars in various weights and designs. Most of their gold bars have .9999 pure gold content and come with tamper-evident packaging and an assay card for authenticity.

Final Thoughts

Choosing the right gold bar weight is a personal decision that depends on your budget, storage capabilities, and investment goals. By understanding the different weights available and considering the factors mentioned above, you can make an informed decision that suits your needs. Remember, investing in gold is not just about buying a piece of metal; it’s about securing your financial future.

Gold Bar Weight Market Trends

The world of gold bar investment is dynamic and ever-evolving. With the global gold bullion market projected to grow at a CAGR of 5.5% from 2022 to 2030, it’s a sector that’s buzzing with innovation and new trends. Let’s dive into some of these exciting developments.

Digital Gold Bar Trading Platforms

The digital revolution has not spared the gold market. Today, digital gold bar trading platforms are gaining popularity. These platforms offer a convenient and secure way to trade gold bars. They provide real-time price updates, ensuring you get the best deal. One such platform is BullionVault. It allows you to buy, sell, and store gold bars digitally.

Increased Interest from Central Banks

Central banks are showing a renewed interest in gold. They are increasing their gold reserves as a hedge against economic uncertainty. This trend is driving up the demand for gold bars, particularly the larger weights.

Price Fluctuations and Market Dynamics

The price of gold bars is subject to market dynamics. Factors such as geopolitical events, economic indicators, and supply and demand affect prices. Keeping an eye on these factors can help you make informed investment decisions.

Traceability and Sustainability

There’s a growing demand for sustainable and traceable gold bars.

Companies like Argor-Heraeus are leading the way in this area. They use DNA markers and PCR tests to ensure the traceability of their gold. This initiative helps to avoid mixing gold of different origins.

AI in Gold Bar Authentication

Artificial Intelligence (AI) is making its way into the gold market. Companies like Alitheon use AI to authenticate physical gold bars. Their FeaturePrint technology creates a digital fingerprint for gold bars. This innovation ensures the authenticity of gold bars, boosting investor confidence.

Blockchain in Gold Trading

Blockchain technology is revolutionizing gold trading. It provides a secure platform for digital storage and exchange of data. This technology ensures transparency and security in gold bar transactions.

In the ever-changing world of gold bar investment, staying updated with the latest trends is crucial. It helps you make informed decisions and maximize your returns. Remember, investing in gold is not just about owning a piece of metal. It’s about securing your financial future. So, keep learning, stay informed, and happy investing!

Gold Bar Weight Maintenance and Care

Investing in gold bars is a wise decision. But, it’s not just about buying and forgetting. Proper care and maintenance are crucial. Let’s explore some tips to keep your gold bars in top-notch condition.

Handle with Care

Gold bars are precious. Handle them with utmost care. Always wash your hands before touching. This prevents oils and dirt from damaging the gold. Consider wearing soft gloves for added protection.

Proper Storage

Storing gold bars is a critical aspect. They need a cool, dry place, away from heat and moisture. This prevents corrosion and maintains the bar’s weight. Avoid PVC containers as they can damage the gold over time. Instead, opt for plastic sleeves or capsules. These provide excellent protection.

At-Home Storage

Storing gold bars at home? It’s possible, but risky. Theft and loss are major concerns. If you choose this route, invest in a high-quality safe. Discreet installation is key. This ensures your gold is well-protected.

Safe Deposit Boxes

Safe deposit boxes are a popular choice. They offer secure storage at a relatively low cost. However, access is limited. Also, separate insurance is often needed.

Private Depositories

For ultimate security, consider private depositories.

They offer secure storage, geographic diversification, and exceptional liquidity. Before choosing, inquire about the holding company’s balance sheet, insurance coverage, third-party audits, delivery options, and collateral use for loans. One such reputable depository is BullionVault.

Check the Weight Regularly

Gold bars don’t lose matter when smashed. But, it’s good to check the weight regularly. This ensures your investment remains intact. Use a reliable scale for accurate measurements.

Keep an Eye on Market Trends

Gold prices fluctuate. Keep an eye on market trends. This helps you understand the value of your investment. Websites like SuperMoney provide valuable financial information.

Invest in Authenticity

Finally, invest in authenticity. Always buy from reputable dealers. Check the stamped weight on the gold bar. Companies like Alitheon use AI to authenticate gold bars. This boosts investor confidence.

In a nutshell, caring for gold bars is as important as buying them. Proper handling, storage, and regular checks can maintain their weight and value. So, invest wisely, care diligently, and watch your wealth grow.

Where to Buy Gold Bars

When it comes to buying gold bars, the choices are plentiful. But, how do you ensure you’re getting the best value for your money? Let’s delve into some key considerations.

Choosing the Right Dealer

Firstly, always buy from reputable dealers. Companies like JM Bullion and APMEX are well-regarded in the industry. They offer a wide range of gold bars in various weights and designs.

Understanding Gold Bar Types

Gold bars come in two types: cast bars and minted ingots. Cast bars are more affordable, while minted ingots are more refined. Both types have their unique appeal. Choose based on your budget and preference.

Checking Purity and Weight

Most gold bars have .9999 pure gold content. They come with tamper-evident packaging and an assay card. This card verifies the weight, purity, and metal content of the bar. It also includes a unique serial number. Always check these details before buying.

Considering Bar Sizes

Gold bars range in size from 1 gram to 1 kilo. Smaller bars are more expensive due to the rarity and value of gold. Larger bars, such as 1 kilo, are traded on the Commodities Exchange. Choose a size that suits your investment goals.

Comparing Prices

Prices for gold bars vary.

They can range from $77 for a 1-gram bar to $64,353 for a kilo bar, depending on the market. Always compare prices from different dealers. Websites like Coin Compare UK can help you find the best deals.

Exploring Payment Options

Reputable dealers like JM Bullion accept major payment methods. They even have a free app for easy purchasing. Some dealers may offer discounts for larger quantities or when using wire transfers.

Being Cautious of Counterfeit Gold

Beware of counterfeit gold dealers. Always trust reputable sources. Companies like Alitheon use AI to authenticate gold bars. This boosts investor confidence.

Considering Storage Options

Once you’ve bought your gold bars, consider your storage options. You can store them at home, in a safe deposit box, or in a private depository like BullionVault.

In essence, buying gold bars is a significant investment. It requires careful consideration and research. Always choose a reputable dealer, understand the types of gold bars, check their purity and weight, consider the size, compare prices, explore payment options, beware of counterfeit gold, and consider your storage options. With these tips, you’re well on your way to making a wise gold bar investment.